An Introduction to FusionFabric.cloud

17 Jun 2020

Videos

Five trends driving the future of finance

6 Dec 2022

Blog Posts & Articles

Finastra Digital Banking Insights to provide visibility into account holder behaviors and preferences

3 Nov 2022

Press Releases

App leverages data and advanced analytics to deliver greater benefits from the Fusion Digital Banking platform

Quarterly Platform Spotlight - March 2022

29 Mar 2022

Blog Posts & Articles

Quarterly product update

14 Mar 2022

Blog Posts & Articles

Why a hacker mindset is needed to transform financial services

11 Mar 2022

Blog Posts & Articles

Quarterly Platform Spotlight - November 2021

7 Dec 2021

Blog Posts & Articles

Quarterly product update

17 Nov 2021

Blog Posts & Articles

Why delaying using open data is one of bankings biggest risks

15 Nov 2021

Blog Posts & Articles

Looking for data insights? Five tips for success

30 Sep 2021

Blog Posts & Articles

A World after LIBOR 2.0 Progress vs Perfection

28 Sep 2021

Blog Posts & Articles

Best practices for the LIBOR transition in loans and lending (Webinar)

28 Sep 2021

Webinar Playbacks

The LIBOR deadline is fast approaching and lending professionals need to make sure they are ready for life after LIBOR. Critical to this is developing and calculating Alternative Reference Rates (ARR) effectively while managing clients’ expectations and operational hurdles. Watch this on-demand webinar to learn techniques and methodologies to successfully transition your lending portfolios.

Networks of networks: The growing importance of supporting global supply chains and international trade

24 Sep 2021

White Papers

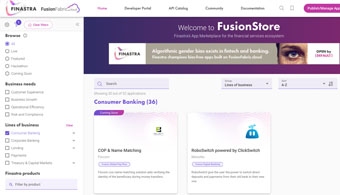

Allied Payment Network brings bitcoin wallet to banks and credit unions through Finastra platform

13 Sep 2021

Press Releases

Allied Bitcoin Wallet, available through Finastra’s FusionStore, enables community financial institutions to offer their customers the ability to buy, sell and hold bitcoin

Quarterly Platform Spotlight - August 2021

26 Aug 2021

Blog Posts & Articles

Finastra and Salt Edge collaborate to provide a more personalized banking experience

18 Aug 2021

Press Releases

Combined offering provides instant PSD2 and global Open Banking compliance for an open, secure and personalized banking experience

Exciting Developments At FusionFabric.cloud

17 Aug 2021

Blog Posts & Articles

Accelerating the Journey to Open Finance - Leveraging Platforms and AI

10 Aug 2021

Blog Posts & Articles

Utilizing data for competitive advantage

14 Jul 2021

Blog Posts & Articles

Transforming financial services

13 Jul 2021

Blog Posts & Articles

Quarterly Platform Spotlight - May 2021

24 May 2021

Blog Posts & Articles

Platformification: How the uptake of as-a-service offerings is redefining finance

29 Apr 2021

Blog Posts & Articles

BANK OF AFRICA selects Conpend TRADE AI app, via Finastra, to digitize trade processes

28 Apr 2021

Press Releases

Conpend’s TRADE AI app will help reduce risk and speed up trade finance transactions

Finastra and HUBX collaborate to streamline loan syndication process

13 Apr 2021

Press Releases

Combined offering increases efficiency for lenders, introduces liquidity to the market and ultimately improves customer experience

Finastra integrates Enigio solution with Fusion Trade Innovation to make paperless trade finance a reality

25 Mar 2021

Press Releases

More than 90% cost savings could be possible from using distributed ledger technology to handle authoritative digital original documents

FusionOperate Case Study

19 Mar 2021

Brochures

The new updated FusionStore is now live!

12 Mar 2021

Blog Posts & Articles

Platformification in banking: differentiate to succeed

9 Mar 2021

Blog Posts & Articles

Pathways to competitive advantage in the era of digital transformation

1 Mar 2021

White Papers

BankBI – Financial performance management in the cloud

22 Feb 2021

Webinar Playbacks

Best practices for compliance and fraud prevention in a real-time world

9 Feb 2021

Webinar Playbacks

Retail Banking: Fraud & financial crime prevention

9 Feb 2021

Webinar Playbacks

Expediting loan origination through digital customer onboarding and document verification

9 Feb 2021

Webinar Playbacks

Finastra offers commercial incentives to broaden its App Marketplace, powered by FusionFabric.cloud

8 Feb 2021

Blog Posts & Articles

Climate First Bank (I/O) selects Finastra software to deliver values-based banking

8 Feb 2021

Press Releases

Climate First Bank (I/O) appoints a technology partner that shares its vision while delivering an open and flexible suite of cloud-based solutions

Finastra Universe 2021: Focus on our FusionFabric.cloud platform

5 Feb 2021

Blog Posts & Articles

Quarterly Platform Spotlight - February 2021

5 Feb 2021

Blog Posts & Articles

Connecting Middle East and Africa to a wider corporate banking ecosystem

4 Feb 2021

Brochures

Connecting Asia Pacific to a wider corporate banking ecosystem

4 Feb 2021

Brochures

Connecting America to a wider corporate banking ecosystem

4 Feb 2021

Brochures

Connecting Europe to a wider corporate banking ecosystem

4 Feb 2021

Brochures

Platformification in banking: new business models

27 Jan 2021

Blog Posts & Articles

Changing customer needs really tested the digital capabilities of financial institutions in 2020, spurring a huge acceleration in the pace of digital transformation across the industry. If banks and credit unions don’t already have a clear strategy for how to keep pace with tech innovation in today’s rapidly evolving financial services landscape, they need to put one in place. Fast.

Create vs collaborate: how to integrate apps in your digital service

19 Jan 2021

Blog Posts & Articles

KBC Bank chooses Finastra for LIBOR transition

13 Jan 2021

Press Releases

Fusion Loan IQ Alternative Reference Rate module and Fusion LIBOR Transition Calculator will help the bank move away from LIBOR

Corporate banking APIs: Opening new horizons

13 Jan 2021

White Papers

Powering the future of payments with Open Banking

7 Jan 2021

White Papers

The power of a payment's ecosystem

22 Dec 2020

Brochures

7 keys to winning with data

18 Dec 2020

Webinar Playbacks

5 digital trends driving the future of customer experiences in financial services

11 Dec 2020

Blog Posts & Articles

In an increasingly competitive financial services market, customer experience is becoming a key driver of retention, growth and competitive advantage. As account holders expect more from their financial institutions, providers will need to keep up. Luckily, Fintech apps could be the key to adapting.

2021 and beyond: A new platform to bank on

7 Dec 2020

White Papers

Platformification in the new era of Treasury & Capital Markets

1 Dec 2020

Webinar Playbacks

How to improve customer service using conversational AI

20 Nov 2020

Webinar Playbacks

Improving customer success: mobile approvals and beyond

17 Nov 2020

Webinar Playbacks

Scaling customer service instantly with conversational AI

17 Nov 2020

Webinar Playbacks

Turning finance digital: 7 keys to winning with data

9 Nov 2020

White Papers

How to automate credit and market risk calculations

9 Nov 2020

Webinar Playbacks

The power of partnership: how fintech collaboration accelerates digital transformation

22 Oct 2020

Blog Posts & Articles

Finastra and CloudMargin partner to deliver Collateral Management as a Service

22 Oct 2020

Press Releases

Solution will help financial institutions meet time-critical regulatory deadlines and reduce costs associated with managing collateral

How APIs reduce risk in fintech partnerships

21 Oct 2020

Blog Posts & Articles

Quarterly Platform Spotlight

19 Oct 2020

Blog Posts & Articles

Frictionless collaboration speeds up innovation in financial services

13 Oct 2020

White Papers

Why app partnerships are accelerating the future of bank and fintech collaboration

9 Oct 2020

Blog Posts & Articles

How platform fits niche banking

8 Oct 2020

Brochures

It's all about the data: how to prepare for the future of banking

18 Sep 2020

Blog Posts & Articles

Open Banking delivers a new way for financial institutions to consume innovation

9 Sep 2020

Brochures

Platformification in the new era of trade

3 Sep 2020

Webinar Playbacks

Finastra: fintech new routes to market virtual meetup (EMEA)

26 Aug 2020

Webinar Playbacks

Getting personal with APIs to unlock lending

14 Aug 2020

Blog Posts & Articles

Building for transparency and sustainability

7 Aug 2020

Blog Posts & Articles

Behind the Hype: Innovation and accelerators thriving virtually

4 Aug 2020

Webinar Playbacks

Behind the Hype: Customer onboarding post COVID-19

29 Jul 2020

Webinar Playbacks

With COVID-19 accelerating the need to digitally transform, banks must harness their resources and steer their operations towards a new operating model and customer onboarding. A model that need to delivers a highly relevant customer experience, and ensure banks are ensuring the right customers and full identification is carried out with the help of the right technology.

What does it take to be an innovator?

27 Jul 2020

Videos

Behind the Hype: Behind the glass ceiling

23 Jul 2020

Webinar Playbacks

What is an open banking platform?

21 Jul 2020

Videos

Dawn of the platform economy for the new payments horizon

20 Jul 2020

Webinar Playbacks

FusionFabric.cloud Solution Overview

16 Jul 2020

Brochures

Machine Learning challenges in legacy organizations

16 Jul 2020

Blog Posts & Articles

Better, Faster Innovation with Platformification

9 Jul 2020

Videos

Behind the Hype: Federated Learning

8 Jul 2020

Webinar Playbacks

Ask Me Anything: Omnichannel

6 Jul 2020

Videos

Behind the Hype: The tech evolution of home buying

1 Jul 2020

Webinar Playbacks

Behind the Hype: Women in Fintech

29 Jun 2020

Webinar Playbacks

Behind the Hype: Blockchain - a fintech perspective

24 Jun 2020

Webinar Playbacks

How to make your ML algorithms think like a human

22 Jun 2020

Blog Posts & Articles

Behind the Hype: Treasury Explained

17 Jun 2020

Webinar Playbacks

Reaping the real benefits of data sharing

15 Jun 2020

Blog Posts & Articles

What is an API?

15 Jun 2020

Videos

Why communities naturally reduce risk

10 Jun 2020

Blog Posts & Articles

Behind the Hype: Impact Finance

4 Jun 2020

Webinar Playbacks

Ask Me Anything: Growth Strategies

3 Jun 2020

Videos

Behind the Hype: Building an AI app into deployment

28 May 2020

Webinar Playbacks

It’s not all about functionality: the importance of UX in B2B finance applications

26 May 2020

Blog Posts & Articles

Behind the Hype: Establishing a virtual culture

22 May 2020

Webinar Playbacks

Behind the Hype: Build a Bank with Finastra

19 May 2020

Webinar Playbacks

How to use APIs to help your customers see the future

15 May 2020

Blog Posts & Articles

Behind the Hype: Applications of AI in Payments and Data Mgmt

6 May 2020

Webinar Playbacks

FusionFabric.cloud for Financial Institutions (Factsheet)

30 Apr 2020

Brochures

Ask Me Anything: Chatbots

28 Apr 2020

Videos

Financial Institutions Define Their Platform Strategy

22 Apr 2020

Brochures

Behind the Hype LIVE: Applications of AI and NLP in fintech

21 Apr 2020

Webinar Playbacks